Rail networks largely consist of electric trains 'tethered' to electric overhead and live rail systems. is This is not feasible everywhere due to the high infrastructure cost per mile, remote geographic locations, and the practicality of building through tunnels and bridges. For these stretches of track, rail OEMs and operators currently rely on diesel fuel - which is their number two cost. Use of diesel cannot continue forever in any market, and multiple rail OEMs and operators believe the time is now to transition towards zero emission rail technologies.

The IDTechEx report shows demand for untethered electric trains will increase rapidly as OEMs seek to reduce high diesel costs and follow broad climate goals such as the Paris Agreement and 'Fit for 55' in Europe. This has driven and will continue to drive rapid advancement of Li-ion battery technology.

Systems up to 14.5MWh are being installed today in the largest trains, known as battery electric (BEV) locomotives, or BELs. In the future, the vast energy requirements of rail will eventually lead to some of the largest traction battery deployments across all electric vehicle markets - potentially beyond 20MWh per train. Improvements in battery energy density and charging technology is expected to increase, with the longest-range requirements creating opportunities for green hydrogen fuel cells.

In the report, IDTechEx assesses the global opportunities emerging for battery-electric (BEV) and fuel cell (FC) trains as diesel use declines and energy storage technologies advance rapidly. Granular 20-year forecasts include train deliveries, battery demand (GWh), fuel cell demand (MW) and market value ($ billion) across locomotives, multiple units, and shunter trains. The cost evolution of railroad batteries, fuel cells and green hydrogen is also explored to assess the long-term feasibility of each solution, drawing from primary research across multiple company interviews.

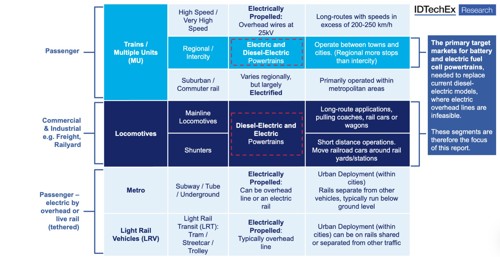

Electric trains: Locomotives, shunters & multiple units

The report outlines how initial rail electrification will be led by multiple units (MU), which are trains used for passenger operations. BEV MUs are being developed to replace the diesel MUs currently operating between regional and intercity lines. Initial deployments have focused on route lengths of up to around 100km, while

In the longer term, electrification will be led by mainline and shunter locomotives. This sector does not require range and has greater potential for opportunity charging. As a result, there is a wider range of energy storage possibilities, from LTO to typical G/NMC based Li-ion batteries, with analysis in the report.

Mainline locomotives are largely commercial & industrial freight trains, although this varies between key electrification regions such as the US, Europe, and China. Locomotives have a larger addressable market than multiple units, and since they are larger and more expensive vehicles, often with long range requirements, they require mega-watt hour battery systems. Locomotives represent the greatest opportunity for the heavy-duty battery supply chain, with battery demand assessed in the report.

Rail Li-ion battery systems, fuel cell systems, and green hydrogen

Battery-electric vehicles are at the forefront of the zero-emission technology being considered in rail, and improvements in battery energy density and charging technology is expected to increase over the forecast period. In the report, IDTechEx evaluates different battery chemistry options and their suitability for trains, comparing NMC, NCA, LFP, LTO, solid-state and lithium metal.

Energy regeneration and route efficiency optimisation plays a large role in reducing energy (fuel) needs and has been a focus of the diesel industry for decades. This has laid the groundwork for BEV train adoption, where fuel economy will be the primary driver.

An advanced energy management system (EMS) will have exact knowledge of the train (the number of locomotives/power), the track length, the train's load, the terrain, the signal and speed limits and more to optimize for fuel efficiency.

While there are many fuel cell suppliers for heavy duty EV applications, a small number are specifically targeting the rail market, although IDTechEx expects most can pivot to the sector as the opportunity emerges (another prime example of this is the marine market).

Most companies make PEMFC with a small number making SOFC mostly targeted at stationary or marine markets. Ultimately, the high cost of green hydrogen, explored in the report, will remain a long-term challenge, while grey hydrogen will not be approved for use due to high carbon emissions.